How are online labour markets reacting to the COVID-19 crisis? Does demand for online work diminish, as companies are facing declining revenues and reduce non-essential spending, or could the pandemic lock-down lead to additional demand for remote work? In one of our last iLabour blog posts, we briefly talked about these two opposite effects, as the downscaling loss (reduction in demand) and the distancing bonus (increase in demand).

Now, in our recent study “Distancing Bonus or Downscaling Loss? The Changing Livelihood of US Online Workers in Times of COVID-19” (forthcoming in the Journal of Economic and Social Geography), we took a closer look at the dynamics of online labour markets in times of COVID-19: For the United States, we examined data from the Online Labour Index, our computational system that tracks demand on leading online labour platforms in real time. The Online Labour Index categorises online labour into six different occupations: Clerical and data entry, professional services, software development and technology, creative and multimedia, sales and marketing support, and writing and translation.

Demand for IT workers, cuts for others

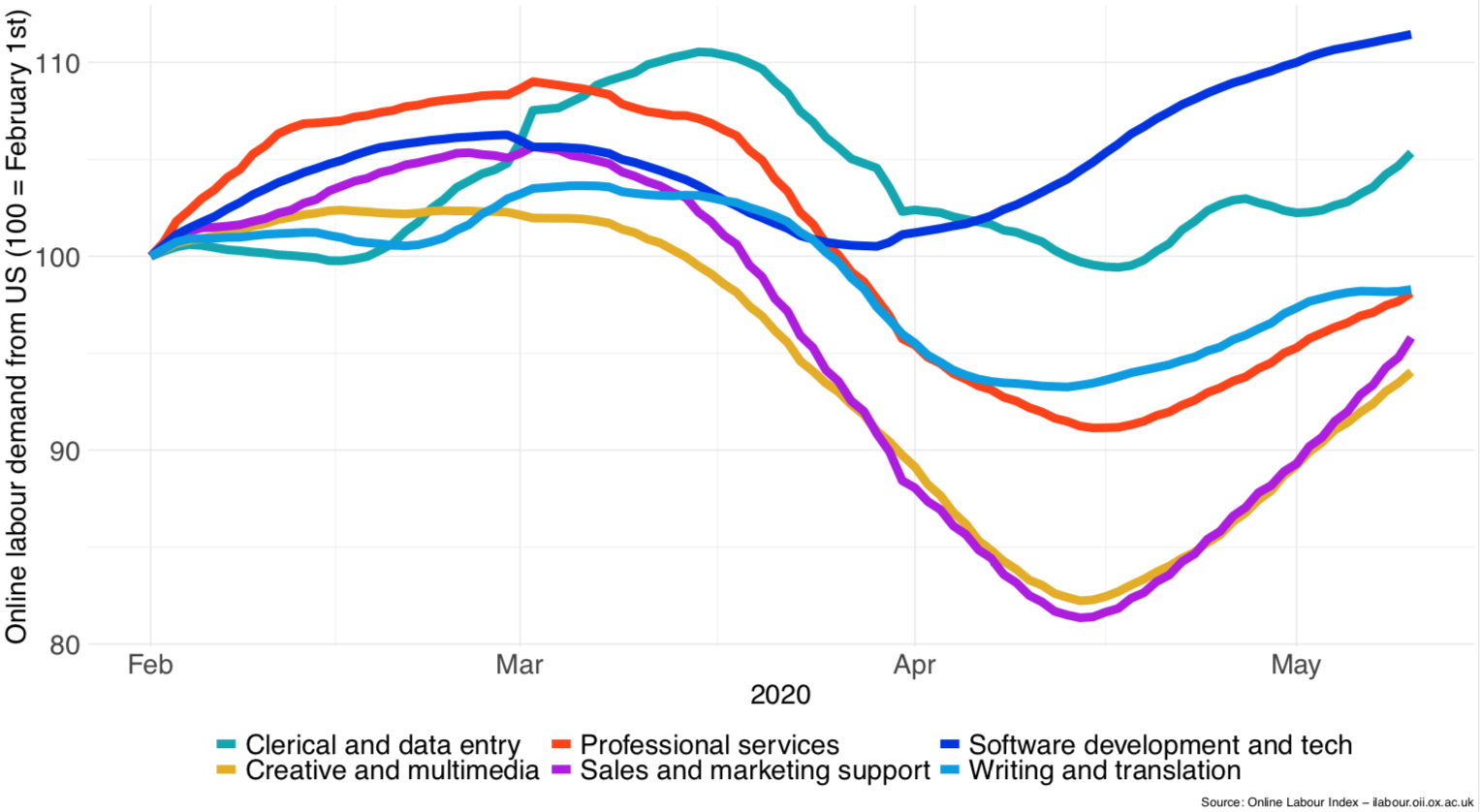

Figure 1: Demand on leading online labour platforms from the US by occupation. Source: Online Labour Index.

As Figure 1 shows, not all occupations have experienced the effects of the pandemic in the same way. Demand in creative & multimedia as well as sales and marketing support work shrunk significantly as the pandemic unfolded. But requests for projects in the software development & technology category remained largely unaffected. This finding is consistent with an interpretation that companies cut non-essential freelance contracts, such as marketing and sales campaigns, while maintaining freelance outsourcing that is essential for continued business operations, such as tech support and database management.

The occupations that experienced deep cuts are slowly bouncing back, but the winner occupations are experiencing even more demand than before the crisis. This is consistent with the idea that the rapid push towards videoconferencing and other remote operations across companies has created additional demand for freelance IT specialists who are able to help with this.

Labour supply growing

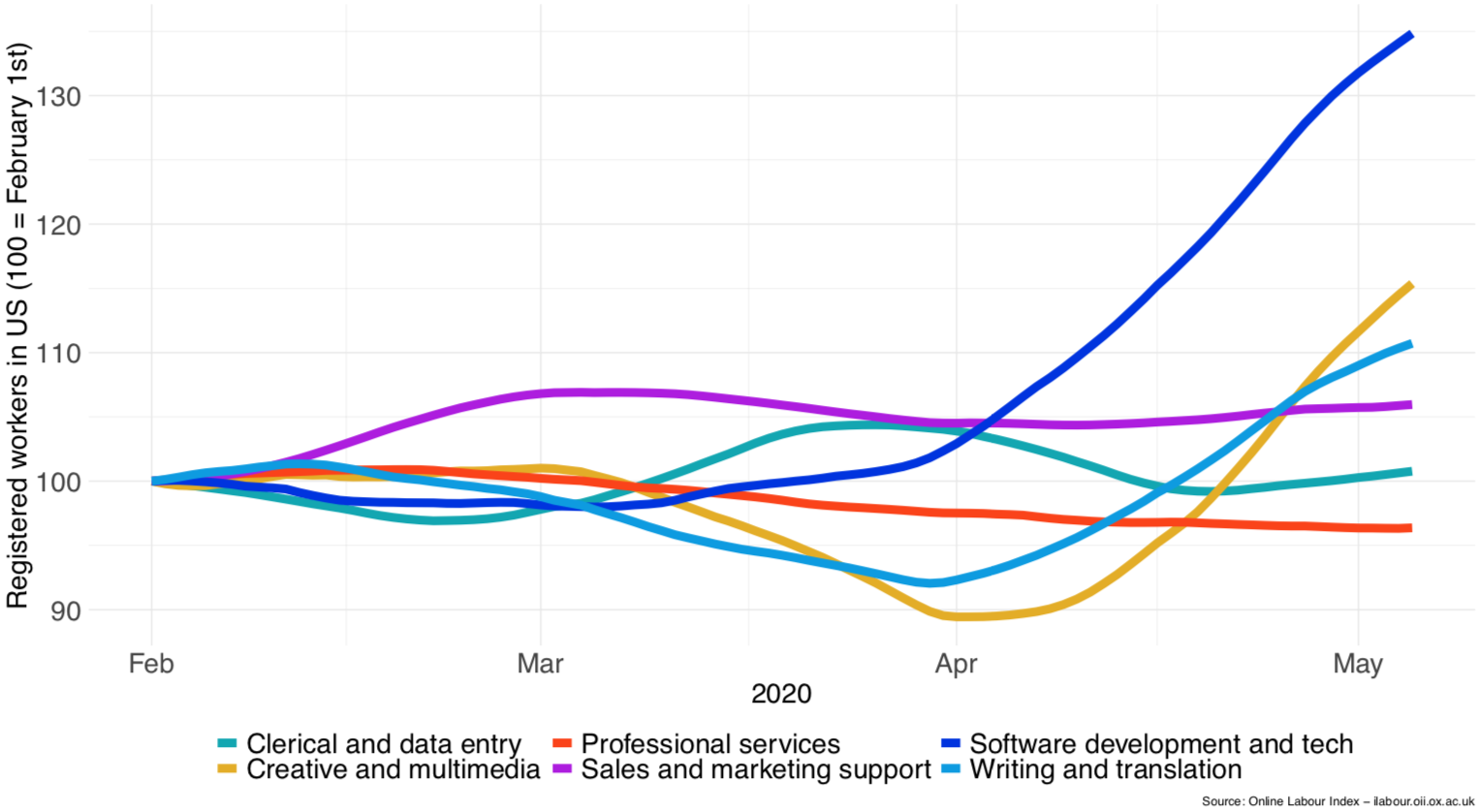

While the Online Labour Index does not provide us with a direct measure of labour supply, we are able to observe the number of registered worker profiles on a subset set of online labour platforms. An increase in the number of registered freelancer profiles in the United States is evident since the beginning of April. In particular, as shown in Figure 2, a very significant number of new freelancers have registered in the software development and technology category.

Figure 2: Worker profiles in the US on leading online labour platforms by occupation. Source: Online Labour Index.

Other occupations do not show a similar increase in registered workers. This is consistent with an interpretation that recently laid-off workers across the economy are not registering en masse on online labour platforms to attempt to make up for lost income. Some workers are probably doing so, but to some extent the increased supply in the software development and technology category might also be attributable to the pull of increased opportunities due to growing demand. In sum, while we observe a downscaling loss for most online labour occupations in the United States, software and tech jobs appear to profit from a distancing bonus effect.

Rush of registrations outpacing demand

However, even in this category “labour supply” growth in the United States appears to have outpaced labour demand growth, suggesting that the workers are likely to be experiencing a tight market. For more details, including qualitative data on the workers’ experiences, take a look at our paper, which also draws on interviews in the U.S. to illuminate how these trends manifest in workers’ lived experiences.