“While it may seem trivial if, for example, a housewife spends ten minutes filling out an online survey for a dollar, if there are millions such housewives, spending hundreds of thousands of hours filling out surveys for millions of dollars, it becomes an important contribution to the measure of labor input in the market research industry, to our measure of productivity in that industry, and to our measure of total employment and average wages for the economy as a whole as well as that industry.”

Previous quote is from a paper[1] presented in the Society of Labor Economists annual conference in 2013. It highlights the problems that both policymakers and labour market researchers face due to digital transformation which the labour markets are going through. Today, more and more work is transacted purely online, outside of typical contractual and regulated job markets. This work remains largely unaccounted in official labour market statistics. Finding reliable information on the total volume of work transacted via online labour market platforms (OLMs) is difficult because there is no publicly available data on them.

Demand for the information has motivated a fair amount of prior research. For instance, World Bank report [2] from last year used a combination of publicly available data from platforms, and industry interviews to estimate total service revenues of OLMs. More recently, JP Morgan Chase & Co studied [3] their customers’ checking account transactions to estimate how many Americans transact their work via OLMs. Finally, United States statistics agency BLS is planning to restart the collection of the Contingent Worker Supplement to Current Population Survey in 2017 (the survey was discontinued in 2005 due to lack of funding). [4] Similar survey was also recently conducted for the United Kingdom. [5]

Despite their indisputable merits, all of these examples have some limitations. First, they are designed to be one-shot analyses, and do not allow for real-time tracking of OLMs. Further, several of these examples only concentrate on the labour market of a single country.

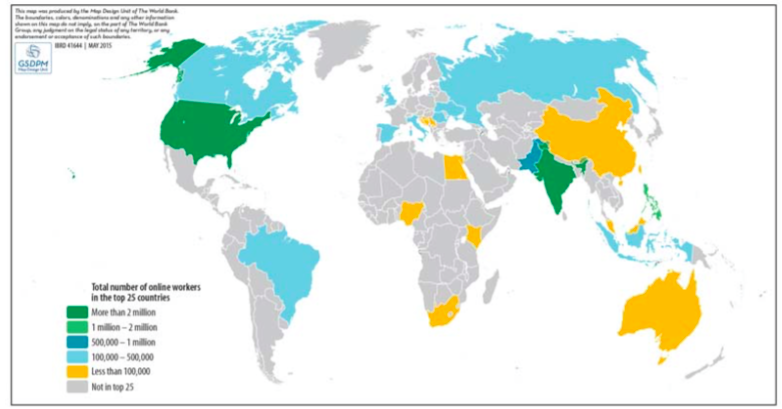

The latter point is especially relevant, because the OLMs are highly international (see fig. 1). The workers on most OLMs are predominantly from low and middle income countries, whereas the employers are mostly from affluent countries. As a result of the recent growth in of online labour markets, it is possible that they are starting to obtain national economic significance, especially in the low income countries.

Fig. 1. Global supply of online workers. (World Bank (2015), p. 29)

To address the gaps in existing data sources discussed in this post, we are building The Online Labour Index (OLI), a set of aggregate measures on online labour utilisation. The index is calculated from the number of tasks, projects, and openings listed and completed across the most prominent marketplaces marketplaces in a given time period. The marketplaces are chosen to be representative both linguistically and geographically. Our intended audience are both researchers and public policymakers.

We will launch the Online Labour Index later this year. Stay tuned!

References

[1] Zoghi, C. & Mohr R (2013): Micro-Economies: The Economics of Informal Micro-Jobs (link)

[2] World Bank Group (2015): The Global Opportunity in Online Outsourcing. (link)

[3] JP Morgan & Chase co. (2016): Paychecks, Paydays, and the Online Platform Economy: Big Data on Income Volatility (link)

[4] US Department of Labor (2016): Innovation and the Contingent Workforce (link)

[5] Huws, U & Joyce, S. (2016): Size of the UK’s “Gig Economy” Revealed for the First Time (link)

This post is based on our paper Building the Online Labour Index: A Tool for Policy and Research. The paper is presented in “The Future of Platforms as Sites of Work, Collaboration and Trust” workshop in CSCW San Francisco next week. You can find our paper, along with other interesting pieces of work here: https://futureofplatforms.wordpress.com/position-papers/.